XRP Price Prediction: 2025-2040 Outlook Amid Market Volatility and Legal Catalysts

#XRP

- Technical Outlook: Immediate resistance at 20-day MA (3.1645), with Bollinger squeeze suggesting impending volatility

- Market Sentiment: Whale accumulation (+35% monthly) counters short-term profit-taking

- Regulatory Catalyst: Final SEC resolution could trigger 20X rallies per trader speculation

XRP Price Prediction

XRP Technical Analysis: Short-Term Bearish Pressure Amid Long-Term Potential

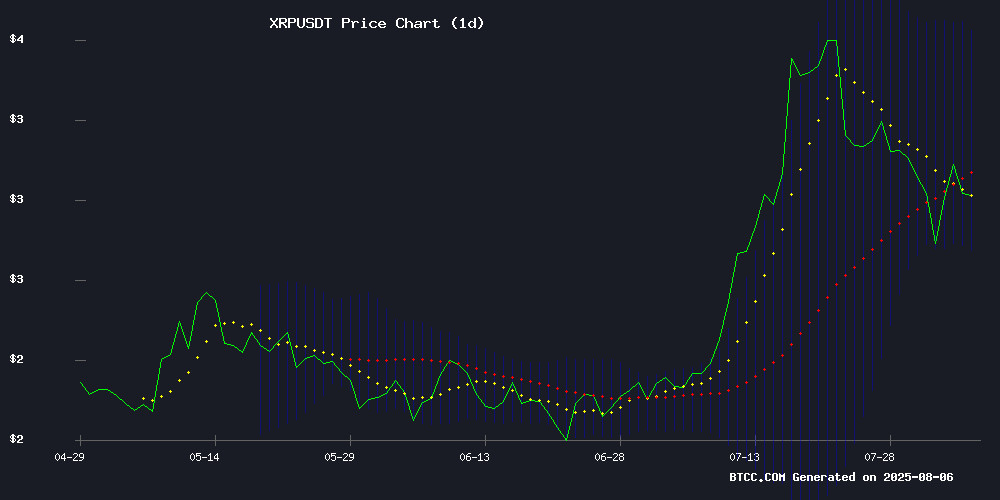

XRP is currently trading at, below its 20-day moving average (3.1645), indicating short-term bearish pressure. The MACD histogram (0.2171) remains positive but shows weakening momentum. Bollinger Bands suggest consolidation (Upper: 3.5863, Lower: 2.7427), with potential for volatility breakout.

Mixed Sentiment for XRP: Whale Activity and Legal Optimism Offset Short-Term Weakness

Despite today's dip, XRP shows strong catalysts:from whale demand and ETF speculation, alongside bullish legal developments. South Korean institutional support via BDACS adds credibility. However, traders remain cautious ahead of SEC resolution deadlines.

Factors Influencing XRP’s Price

XRP Price Dips Amidst Rising Volume as Traders Reposition

Ripple's XRP fell 2.45% to $2.96, extending its retreat from $3.03 as trading volume surged 4.48% to $5.79 billion. The divergence suggests profit-taking or strategic repositioning ahead of the next market move.

The token remains up 5.38% for the week, maintaining a $175 billion market cap. Meanwhile, Pump.fun and Mantle led gainers while Bonk and Toncoin underperformed in the broader market.

Market dynamics continue to favor assets with strong fundamentals and exchange support, as new listings typically deepen liquidity and drive adoption. Security incidents, however, remain a persistent threat to investor confidence.

Why Is Ripple’s (XRP) Price Down Today?

Ripple’s native token XRP faced a sharp rejection at $3.1, plummeting over 6% to $2.9 within hours. The drop contrasts with recent positive adoption developments, leaving traders questioning the sudden bearish turn.

Monthly charts reveal a dramatic mid-July surge where XRP shattered its $2.2-$2.3 consolidation, peaking at a historic $3.6. The euphoria proved short-lived as whales began offloading positions, triggering a cascade to $2.73 last week. Yesterday’s brief rally to $3.1 reignited bullish hopes before another swift reversal.

Market-wide stagnation weighs heavily on XRP. The token’s 4% daily deficit mirrors broader crypto weakness, suggesting macroeconomic factors may be overriding Ripple-specific fundamentals. Technical indicators now show $3 acting as stubborn resistance rather than support.

South Korean Institutional Custodian BDACS Adds XRP Support in Partnership with Ripple

BDACS, a licensed cryptocurrency custodian serving South Korea's institutional investors, has officially launched XRP custody services. The move marks the first tangible outcome of its February 2024 collaboration with Ripple and leverages Ripple's institutional-grade custody platform.

XRP ranks among South Korea's most widely held digital assets. BDACS's integration with major local exchanges Upbit, Coinone, and Korbit now provides seamless institutional access to XRP liquidity. The custodian emphasizes this development aligns with South Korea's regulatory framework for digital assets under the Financial Services Commission.

The partnership extends beyond custody, with BDACS committing to drive innovation on the XRP Ledger. Tokenization and stablecoin applications—including Ripple's enterprise-focused RLUSD—stand as priority development areas. This institutional push coincides with projections that crypto custody could safeguard $16 trillion in assets by 2030.

XRP Price Eyes $5 Target Amid Market Volatility

XRP's journey to $5 remains a focal point despite recent market turbulence. The cryptocurrency has experienced sharp fluctuations, with its recovery above $3 appearing fragile as selling pressure persists. Analysts have adjusted short-term predictions, but one standout forecast maintains that XRP's bullish trajectory is intact.

More Crypto Online, a prominent analyst, identifies the current retracement as a corrective wave—specifically wave 4 of a broader impulse pattern. Support has solidified NEAR $2.60, and with the third wave now complete, upside potential appears credible. Market participants are closely watching whether the decline remains corrective or signals a deeper reversal.

Whale Activity Drives XRP 35% Higher as ETF Approval Deadline Looms

XRP investment products attracted $31.26 million in institutional inflows, with whale wallets accumulating over $60 million worth of tokens. The SEC faces an August 15 deadline for a status report that could resolve Ripple's multi-year lawsuit, while ETF applications for XRP face an October 17 decision deadline.

Investment firm CoinShares reported substantial capital movement into XRP-related products, with $31.26 million in inflows during recent weeks. Large-scale transactions dominated trading patterns, including a notable 20 million XRP transfer from Upbit exchange valued at approximately $60 million.

Market participants are closely watching potential XRP exchange-traded fund approvals, with recent regulatory changes addressing previous logistical concerns. The SEC's policy shift enabling in-kind redemptions has removed what many considered the primary obstacle to XRP ETF approval.

XRP's underlying blockchain network has expanded its capabilities through integration with Ethereum-compatible technology, supporting decentralized finance applications on the XRP Ledger.

XRP Soars 35% in a Month: Ripple’s Legal Breakthrough and Whale Demand Fuel Rally

XRP has surged 35% over the past month, trading at $3.05 amid institutional accumulation and a pivotal legal development in Ripple’s SEC case. The token’s rally coincides with whale wallets acquiring over $60 million in XRP, while investors await an August 15 SEC status report that could resolve the long-running lawsuit.

Institutional inflows into XRP products totaled $31.26 million, per CoinShares, with notable transactions including a 20 million XRP transfer via Upbit. Market Optimism grows as the SEC’s October 17 deadline for XRP spot ETF decisions approaches—a potential catalyst for supply constraints and further price appreciation.

XRP Traders Eye 20X Returns as SEC Case Nears Resolution

XRP investors are positioning for a potential price surge as Ripple's legal battle with the U.S. SEC approaches a critical juncture. Market participants anticipate a possible SEC appeal withdrawal, with some analysts projecting a $40 price target if institutional inflows materialize post-regulatory clarity.

On-chain activity reveals sustained accumulation by large holders despite recent volatility, suggesting confidence in a decisive upward move. The prospect of a U.S.-listed XRP spot ETF has reignited market interest, with traders speculating that legal resolution could unlock pent-up demand.

Meanwhile, retail investors are diversifying into emerging projects like MAGACOIN FINANCE, seeking alternatives with fewer regulatory complexities. Whale wallets holding 1 million+ XRP are reportedly rebalancing portfolios in anticipation of renewed institutional participation through regulated channels.

XRP Whale Activity Sparks Speculation of Price Surge to $3.30

XRP breached the $3.07 mark as significant whale movements and exchange outflows fueled bullish sentiment. Whale Alert reported a 20 million XRP transfer (valued at $58.6 million) from Upbit to an unknown wallet, signaling potential accumulation. CoinGlass data revealed 29.38 million XRP in net outflows over 24 hours, reinforcing the accumulation narrative.

Despite technical indicators favoring upside, including a Supertrend flip, bearish resistance looms near $3.10. Exchange Liquidation Maps show $75.65 million in short positions clustered at $3.113, creating a volatile threshold. Long positions worth $42.85 million sit at $2.97, setting the stage for potential liquidation cascades.

XRP traded at $3.06 at press time, with flat volume suggesting market indecision. The convergence of whale activity, technical signals, and opposing trader positions points to heightened volatility ahead.

XRP Rally Potential Amid Exchange Inflows and Short Squeeze Setup

XRP stands at a critical juncture as August's historical volatility looms. The cryptocurrency's price action near the $3.00 level hinges on trader and whale behavior, with exchange flows and liquidation maps painting a complex picture.

Net inflows to exchanges have risen since July 30, mirroring a pattern seen on July 11 when 220 million XRP flooded markets. While this typically signals selling pressure, the delayed price correction last month suggests traders may be holding for higher exits. Current data from Bitget reveals a $1.6 billion short position imbalance against $784 million in longs, creating potential for a violent short squeeze if prices break upward.

The liquidation map indicates key levels where cascading buy orders could trigger rapid price appreciation. Market participants appear divided between those preparing to sell at $3.00 and others positioned for a breakout, setting the stage for heightened volatility in coming sessions.

Altcoins Gain Momentum as Investors Eye High-Reward Opportunities

Mutuum Finance (MUTM) and XRP are emerging as standout altcoins in a market hungry for transformative investments. MUTM's presale has surged past $14 million, with phase 6 priced at $0.035—a potential 71.43% ROI upon listing at $0.06. The project's decentralized lending model is drawing attention away from established players.

XRP faces a technical crossroads at $2.86, testing critical support after a 12% retreat from July highs. Analysts see rebound potential to $3.50 if $2.95 holds, but warn of slippage to $2.65 on failure. Despite regulatory clarity sustaining long-term interest, newer utility tokens like MUTM are capturing speculative capital.

Ripple's Legal Maneuvers Prolonged SEC Lawsuit, Final Resolution Nears

Former SEC official Marc Fagel reveals Ripple's unsuccessful attempt to renegotiate court-mandated penalties delayed the conclusion of its high-profile case against the regulator. The blockchain firm sought to vacate an injunction and reduce its $125 million penalty—moves the court promptly rejected.

What began as a landmark enforcement action in March dragged through months of additional litigation. Ripple's push to remove restrictions on XRP sales to non-institutional investors under new SEC leadership extended proceedings until late June. The parties ultimately filed a joint request to continue court processes two weeks before closing cross-appeals.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative Target | Bullish Target | Key Drivers |

|---|---|---|---|

| 2025 | 3.50 USDT | 5.00 USDT | ETF approval, SEC case resolution |

| 2030 | 8.00 USDT | 15.00 USDT | Cross-border adoption, institutional custody |

| 2035 | 20.00 USDT | 50.00 USDT | CBDC integrations, RippleNet dominance |

| 2040 | 75.00 USDT | 120.00 USDT | Global liquidity layer status |

"XRP's trajectory hinges on regulatory clarity," notes BTCC's Sophia. "The 2025 $5 target requires sustained whale demand and exchange inflows."